The smart Trick of Pvm Accounting That Nobody is Talking About

The smart Trick of Pvm Accounting That Nobody is Talking About

Blog Article

The 10-Second Trick For Pvm Accounting

Table of ContentsThe 3-Minute Rule for Pvm AccountingSome Ideas on Pvm Accounting You Need To KnowThe Best Guide To Pvm AccountingThe Of Pvm AccountingExcitement About Pvm AccountingPvm Accounting Things To Know Before You Buy

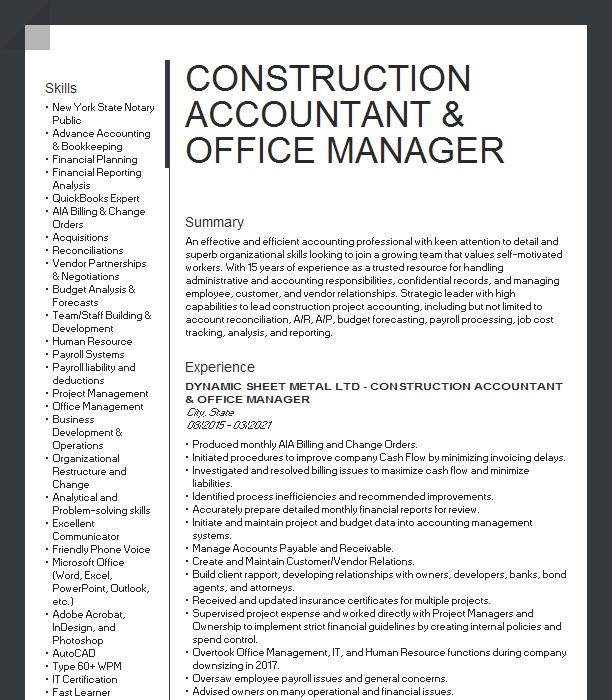

Look after and deal with the development and approval of all project-related payments to customers to foster good interaction and prevent issues. financial reports. Make sure that suitable reports and documents are sent to and are updated with the IRS. Ensure that the accountancy process adheres to the law. Apply needed construction bookkeeping requirements and procedures to the recording and coverage of construction activity.Understand and maintain typical cost codes in the accounting system. Communicate with various funding agencies (i.e. Title Company, Escrow Company) regarding the pay application process and requirements needed for settlement. Take care of lien waiver dispensation and collection - https://trello.com/w/pvmaccount1ng. Display and resolve bank issues including fee anomalies and check differences. Help with implementing and preserving interior economic controls and treatments.

The above declarations are meant to define the basic nature and level of work being executed by individuals designated to this classification. They are not to be interpreted as an exhaustive checklist of obligations, responsibilities, and skills called for. Workers may be needed to carry out duties beyond their typical obligations every now and then, as needed.

What Does Pvm Accounting Mean?

Accel is looking for a Construction Accountant for the Chicago Workplace. The Construction Accounting professional executes a variety of bookkeeping, insurance policy compliance, and job management.

Principal duties include, yet are not restricted to, dealing with all accounting features of the firm in a prompt and accurate manner and offering records and timetables to the firm's CPA Company in the prep work of all financial statements. Makes sure that all accounting treatments and features are managed precisely. Liable for all financial records, pay-roll, financial and day-to-day operation of the bookkeeping feature.

Works with Task Managers to prepare and upload all regular monthly invoices. Produces monthly Work Expense to Date reports and functioning with PMs to fix up with Task Managers' budget plans for each task.

The Greatest Guide To Pvm Accounting

Proficiency in Sage 300 Building And Construction and Real Estate (previously Sage Timberline Workplace) and Procore construction administration software a plus. https://www.easel.ly/browserEasel/14478975. Need to also excel in various other computer software application systems for the preparation of reports, spread sheets and other accountancy evaluation that might be required by management. construction accounting. Have to possess solid business skills and capability to focus on

They are the economic custodians that guarantee that building jobs continue to be on spending plan, abide by tax policies, and preserve economic openness. Building and construction accountants are not just number crunchers; they are tactical partners in the building process. Their main duty is to manage the financial aspects of building jobs, making sure that sources are alloted successfully and economic threats are minimized.

9 Simple Techniques For Pvm Accounting

They work very closely with job managers to produce and monitor budgets, track costs, and forecast monetary requirements. By keeping a limited grasp on project finances, accountants aid prevent overspending and financial problems. Budgeting is a foundation of successful building jobs, and building accountants are crucial in this respect. They create thorough budget plans that encompass all job expenses, from products and labor to permits and insurance policy.

Construction accountants are skilled in these laws and ensure that the job abides with all tax requirements. To stand out in the function of a building and construction accounting professional, individuals need a solid academic structure in audit and finance.

Furthermore, qualifications such as Qualified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) or Certified Construction Industry Financial Specialist (CCIFP) are very related to in the market. Building jobs typically include tight due dates, altering policies, and unforeseen costs.

The 15-Second Trick For Pvm Accounting

Expert qualifications like certified public accountant or CCIFP are likewise extremely recommended to show proficiency in construction audit. Ans: Building and construction accountants create and straight from the source check budget plans, determining cost-saving opportunities and making certain that the job stays within spending plan. They likewise track expenses and projection financial demands to stop overspending. Ans: Yes, building accounting professionals handle tax obligation compliance for construction tasks.

Introduction to Building Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building firms have to make tough choices among several financial options, like bidding on one job over an additional, selecting financing for products or equipment, or setting a task's profit margin. Building and construction is a notoriously unpredictable market with a high failing rate, sluggish time to settlement, and inconsistent cash money flow.

Normal manufacturerConstruction organization Process-based. Production entails repeated procedures with easily recognizable costs. Project-based. Manufacturing requires various procedures, materials, and tools with varying prices. Dealt with place. Production or production occurs in a solitary (or a number of) regulated locations. Decentralized. Each job happens in a new place with differing site problems and one-of-a-kind challenges.

Excitement About Pvm Accounting

Lasting partnerships with vendors reduce settlements and boost efficiency. Inconsistent. Regular usage of different specialty professionals and distributors affects efficiency and capital. No retainage. Payment gets here completely or with regular payments for the complete agreement quantity. Retainage. Some part of repayment may be withheld till task conclusion even when the specialist's work is finished.

While typical manufacturers have the advantage of regulated settings and maximized production processes, construction companies have to continuously adjust to each brand-new job. Even rather repeatable jobs require alterations due to site conditions and various other variables.

Report this page